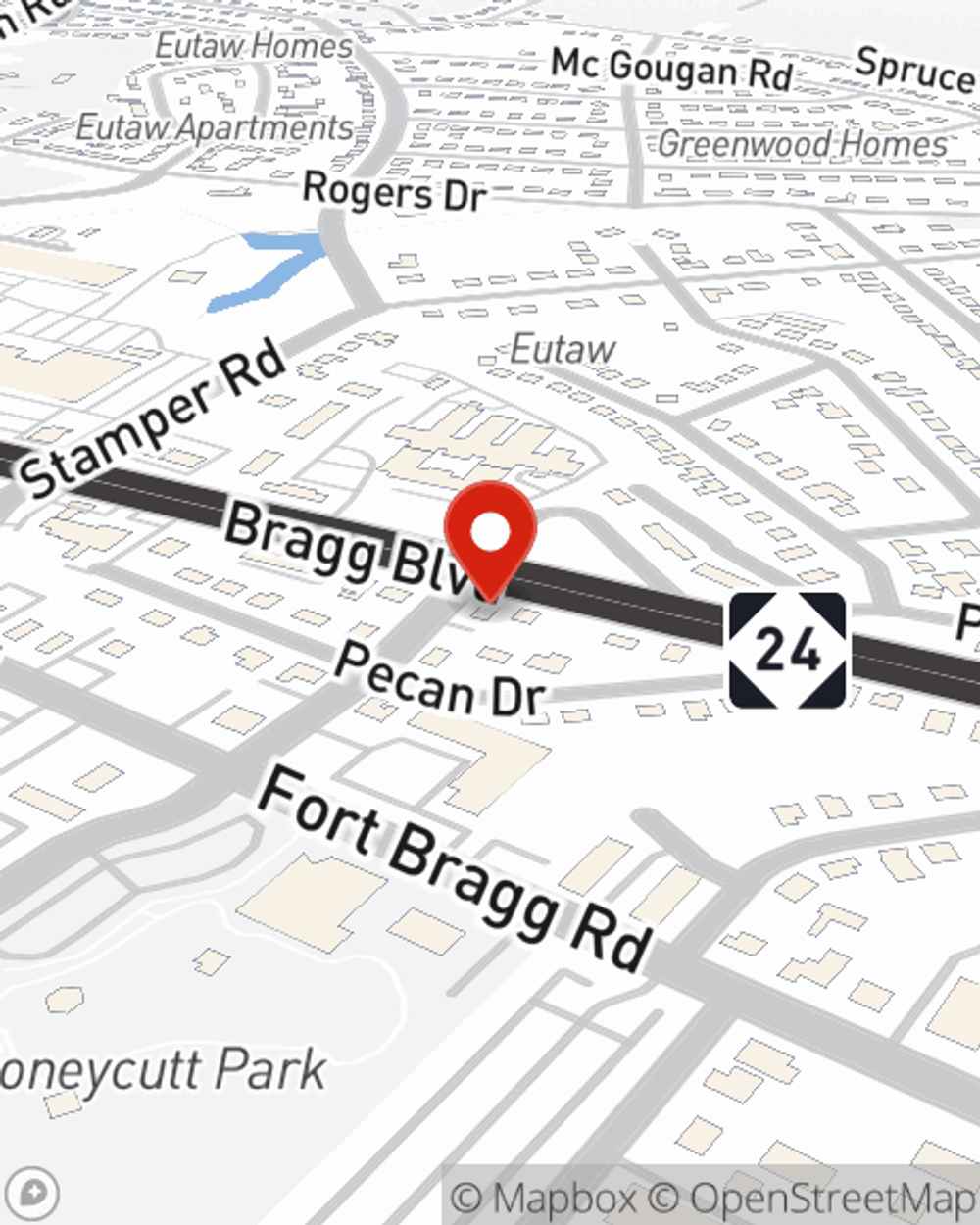

Life Insurance in and around Fayetteville

Get insured for what matters to you

Life happens. Don't wait.

Would you like to create a personalized life quote?

State Farm Offers Life Insurance Options, Too

It may make you uncomfortable to fixate on when you pass, but preparing for that day with life insurance is one of the most significant ways you can show care to your family.

Get insured for what matters to you

Life happens. Don't wait.

Their Future Is Safe With State Farm

Death may be part of life but that doesn’t make it easy. With life insurance from State Farm, loss can be a bit less complicated. Life insurance provides financial support when it’s needed most. Coverage from State Farm gives time to recover without worrying about expenses like college tuition, future savings or phone bills. You can work with State Farm Agent Sean Gordon to show care for your partner with a policy that meets your specific situation and needs. With life insurance from State Farm, you and your loved ones will be cared for every step of the way.

Don’t let fears about your future keep you up at night. Reach out to State Farm Agent Sean Gordon today and find out the advantages of State Farm life insurance.

Have More Questions About Life Insurance?

Call Sean at (910) 483-2055 or visit our FAQ page.

- Build a stronger well-being.

- Get guidance and motivation to strengthen key areas of your overall wellness.

- Explore estate and end-of-life planning tools.

Simple Insights®

What determines the cost of life insurance?

What determines the cost of life insurance?

How do life insurance companies determine rates? And who pays more for life insurance? We break it down.

How to use life insurance to help a special needs child or adult

How to use life insurance to help a special needs child or adult

From life insurance to a special needs trust, here's what you need to know to keep your loved one financially secure.

Sean Gordon

State Farm® Insurance AgentSimple Insights®

What determines the cost of life insurance?

What determines the cost of life insurance?

How do life insurance companies determine rates? And who pays more for life insurance? We break it down.

How to use life insurance to help a special needs child or adult

How to use life insurance to help a special needs child or adult

From life insurance to a special needs trust, here's what you need to know to keep your loved one financially secure.